An update on market volatility

Hear from Darren Spencer, Mercer’s Lead Investment Director. With nearly 30 years of investments expertise, Darren offers valuable insights on navigating periods of volatility. He emphasises the importance of carefully considering whether to switch investments in response to market changes.

What is market volatility?

Market volatility is a term used to describe the ups and downs in the value of investment assets. The value of any asset – whether it’s shares, property, bonds, or commodities like gold – can fluctuate over the short-term, sometimes wildly.

While all asset types can experience volatility, it’s most commonly linked to share markets. That’s because share prices can fluctuate over days, weeks, or months. However, despite these fluctuations, share markets have historically shown steady long-term growth.

The causes of market volatility are many and varied. Economic or geopolitical factors, like interest rate changes, inflation, trade disagreements, natural disasters and conflicts, can all impact financial markets and result in volatility.

Covered in this article:

- What is market volatility?

- Volatility and your super

- Market cycles

- Taking control of your super

Volatility and your super

As a superannuation member, your super balance is typically invested in various asset classes and financial markets – and volatility is unavoidable. So don’t be alarmed when your balance drops from time to time.

Unless you’re nearing retirement, your super is a long-term investment, and it’s the long-term results that matter. It’s normal to feel concerned when your account balance dips, but instead of worrying about short-term market volatility, focus on your retirement goals and think in terms of years and decades.

Bulls and bears and market cycles

Markets move in cycles, from lows to highs and back again. A full market cycle can typically include both a “bull market” and a “bear market”, with peaks and troughs in between.

A bull market is an extended period of consistently rising prices. Investor confidence is high, and the economy is usually (but not always) growing.

A bear market is a period of falling prices when investor confidence is low and the economy is in a downturn phase, such as a recession.

Time in the market vs timing the market

Market cycles are unpredictable, and each stage generally only becomes clear in hindsight.

That’s why it’s so difficult, and risky – even for seasoned investors – to try and time the market by buying and selling assets at just the right time. As a super member, you’re likely to remain invested for decades, and “time in the market” has been shown to be a much safer strategy than “timing the market”.

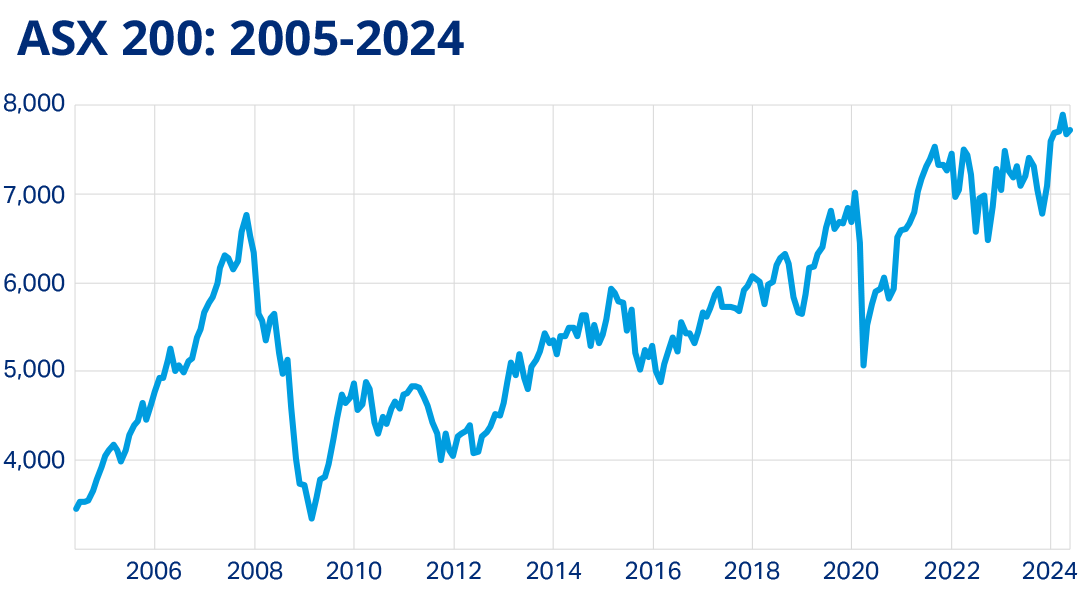

That’s because time often negates the effects of short-term market fluctuations – history shows market values tend to increase over longer periods, despite the ups and downs. For example, the ASX 200 has grown by more than 220% over the past 20 years, despite major volatility events such as the global financial crisis in 2008 and the COVID-19 pandemic.

Source: https://www.marketindex.com.au/asx200 Date as of 23 May, 2024

The S&P/ASX 200 (XJO) is Australia’s leading share market index and contains the top 200 ASX listed companies. It accounts for almost 90% of Australia's share market (April 2024).1

Spending time in the market carries the added benefit of compounding returns over many years. Perhaps the biggest advantage of taking the longer-term view, is that it helps investors resist rash decisions and instead rely on the market to deliver sustainable returns over the long-term.

We’re looking out for you

Mercer’s global investment analysts, researchers, economists, asset class specialists, and portfolio managers are constantly monitoring markets to identify the most important developments and potential opportunities.

We offer single-sector and diversified investment options – including our life stage investment option Mercer SmartPath® – and our experts actively manage portfolios to capture opportunities when markets are rising and help cushion your super balance from the worst when markets are falling.

Stay on track with your super strategy and achieve your lifestyle goals

The Mercer Retirement Income Simulator lets you estimate your retirement income and explore the impact of investment decisions, including making voluntary contributions, changing investment strategy, taking a career break, or adjusting retirement age.

The tool also includes a "stress test" that simulates up to 10 randomly generated scenarios to reflect the possible impact of market volatility on your retirement savings.

Check before you switch

Switching investment options due to market volatility can greatly impact your super balance at retirement. So, it may be worth talking to our financial advice team, or an external financial adviser, before making any decisions.

As a Mercer Super member you have access to a dedicated advice team, at no additional cost. They can provide you with tailored financial advice over the phone regarding your Mercer Super account, including which of our investment options may be right for you.

FAQs

Take control of your super with e-Advice

Recognising how you’re likely to respond to market volatility can help determine how you choose to invest your super.

With e-Advice you can get tailored advice to help you understand your attitude to investment risk and make informed decisions.

Read next:

Diversification and your super

Diversification is a strategy that helps limit exposure to certain investment risks and reduce the risk of large short-term losses.

Investment risk and your super

All investments carry some risk and offer some potential reward – in the form of positive returns. The challenge lies in balancing the two.

Financial confidence through accessible advice

No matter your stage of life, the right advice at the right time can give you the confidence to take control of your financial future.

1 S&P/ASX 200 (LIVE DATA): Share Prices & Charts - Market Index

Disclaimer: Prepared by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence 235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 ('Mercer Super'). This information is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, please consider the Product Disclosure Statement available at mercersuper.com.au/pds. The product Target Market Determination can be found at mercersuper.com.au/tmd. The value of an investment in the Mercer Super Trust may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed. Past performance is not a reliable indicator of future performance.

Mercer Financial Advisers are authorised representatives of Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence 411766. The trustee has appointed MFAAPL to provide financial advice services for members of the Mercer Super Trust.

'MERCER’ is an Australian registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.

The material contained in this document is based on information received in good faith from sources within the market and on our understanding of legislation and government press releases at the date of publication which we believe to be reliable and accurate. Neither Mercer nor any of its related parties accepts any responsibility for any inaccuracy.