Quarterly performance update

January to March 2024

Investment markets closed out 2023 on a high note. This momentum was maintained throughout Q1 2024 – with most Mercer Super members continuing to experience positive returns for another quarter.1

To read more, including detailed performance information download the full report below.

Super performance

Mercer SmartPath®

Our default investment option, Mercer SmartPath continued to deliver solid returns to members. Returns ranged between 3.6% to 6.8% for the quarter – and an impressive +14% for the year to 31 March 2024 for the majority of member groups.2

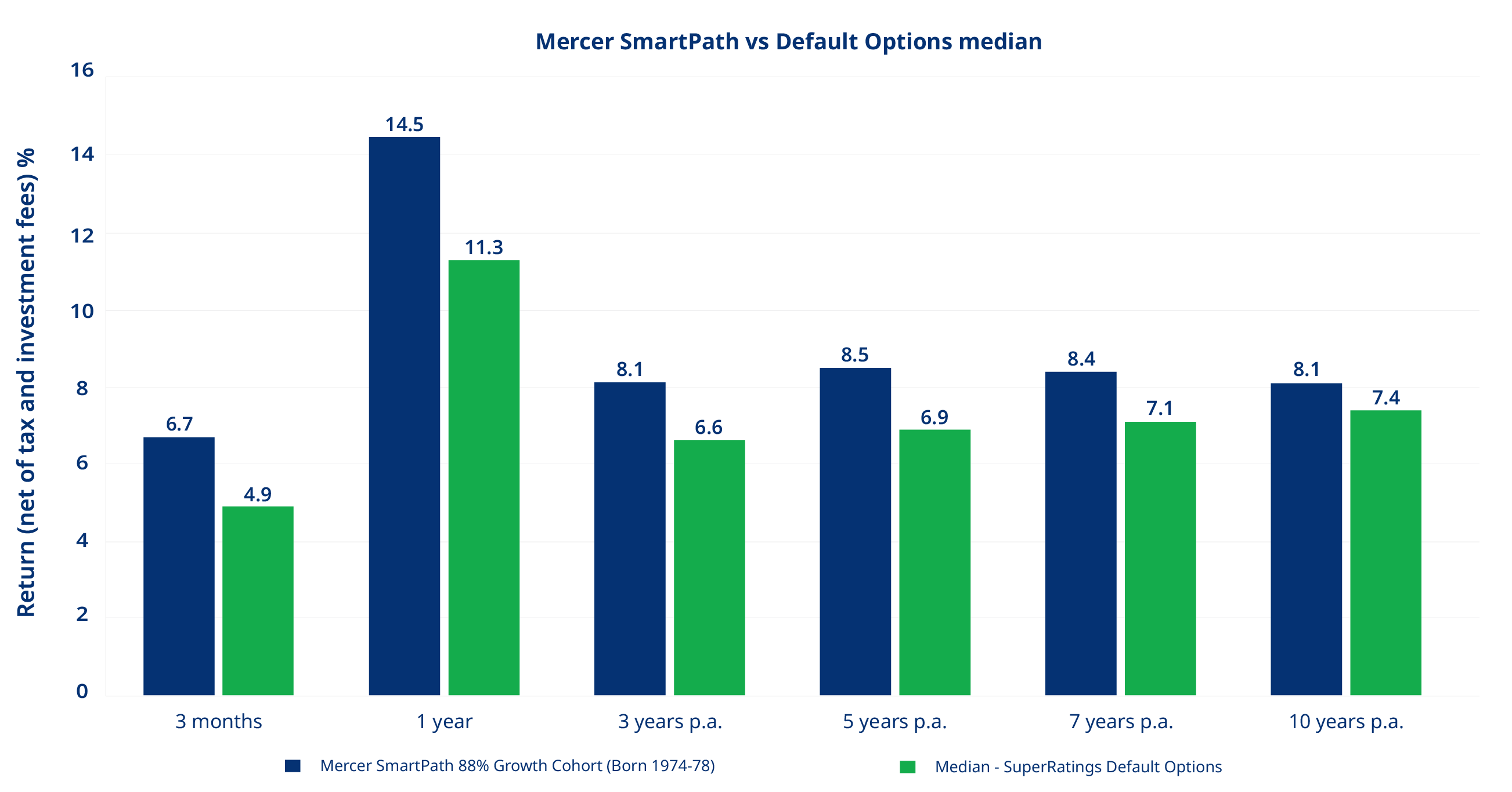

For Q1 2024, over 95% of members invested in Mercer SmartPath3 received returns above the industry default median of 4.9%.4

While over the longer term – where super is best measured – all Mercer SmartPath members under the age of 553 continue to enjoy returns well above the industry median across all time periods.4

Mercer SmartPath vs Default Option median

(after tax and investment fees) 31 March 2024

Mercer Super Trust’s analysis of Mercer SmartPath (born 1974-1978), compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 March 2024. Past performance should not be relied upon as an indicator of future performance.

Ready-made diversified investment options

It was also another positive quarter for our Ready-made diversified choice options, with returns ranging from 2.4% to 7.8%.5 The best performing options were those with a higher exposure to shares generating greater returns, being Mercer Diversified Shares and Mercer High Growth.

Over the longer term, our Ready-made diversified options continue to equal or perform above their respective peer group medians over 3, 5, 7 and 10 years.6

Economic and investment market update

In Australia, economic conditions remained broadly resilient with the labour market remaining strong and business conditions holding up in most sectors. However, the Q4 2023 gross domestic product (GDP) was weak, further evidencing that households are continuing to feel the cost-of-living pressures.

From an international perspective, the US remained resilient, particularly when contrasted with weaker conditions in Europe, the UK, New Zealand, and Japan.7

- International Shares had an impressive quarter, returning 10.1% on a hedged basis and 14.0% on an unhedged basis. This was largely due to listed companies reporting better than expected earnings and as a result, continuing to perform well in this economic environment.

- Australian shares had a positive quarter too, returning 5.4%, which can largely be attributed to encouraging economic data and a positive earnings season.

- International Government Bonds produced a negative return of -0.7% due to bond market's reduced expectations for interest rate cuts this year.

- Australian Government Bonds fared better, returning 0.9%.

Looking ahead

Related:

Mercer SmartPath

Great investors fine-tune their portfolio over time. Mercer SmartPath is designed to do this for you automatically, so you can invest like the experts, without lifting a finger.

Read next:

Diversification and your super

We all know the phrase “don’t put all your eggs in one basket”. If you drop your only basket, you break all your eggs. But if you have many baskets and you drop one, you have eggs to spare. That’s diversification in a nutshell: more baskets = less chance of losing all your eggs in a single stroke.

Investment risk and your super

Risk is something many of us naturally avoid, especially when it comes to our personal well-being or our finances. Reward on the other hand, is a word that draws us in. When it comes to investing, risk and reward are intrinsically linked.

Keep on top of your super performance

How your super performs is important and can have an impact on the funds you have to maintain you in retirement. So it makes sense to keep a close eye on the detail of your fund’s long term returns.

1. Based on Mercer Super membership data as at 31 March 2024 and for members invested for the entire corresponding time period.

2. Mercer Super Trust’s analysis of the Mercer SmartPath investment performance (after investment fees and taxes) for the March 2024 quarter. Mercer SmartPath cohorts up to and including 1969-1973 achieved returns of between 14.4% and 14.7% for the year up to 31 March 2024.

3. Based on Mercer SmartPath membership data as at 31 March 2024 and for members invested for the entire corresponding time period.

4. Mercer Super Trust’s analysis of Mercer SmartPath, compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 March 2024.

5. Mercer Super Trust’s analysis of Mercer Super’s Ready-made diversified investment options performance (after investment fees and taxes) for the March 2024 quarter.

6. Mercer Super Trust’s analysis of Mercer Super’s Ready-made diversified investment options, compared to its respective growth asset ratio fund survey’s median as reported in SuperRatings Fund Crediting Rate Survey as at 31 March 2024.

7. Mercer Super Trust analysis of financial market asset class returns - Quarterly report to 31 March 2024.

Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust (‘Mercer Super’) ABN 19 905 422 981. The material contained on this website is based on information received in good faith from sources within the market and on our understanding of legislation and government press releases at the date of publication which we believe to be reliable and accurate. Neither Mercer nor any of its related parties accepts any responsibility for any inaccuracy. Prior to acting on any information contained on this website, you need to consider the appropriateness of the advice taking into account your own objectives, financial situation and needs, consider the Product Disclosure Statement for any product you are considering, and seek professional advice from a licensed, or appropriately authorised financial adviser if you are unsure of what action to take. The product Target Market Determination can be found at mercersuper.com.au/tmd. The value of an investment in the Mercer Super Trust may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed. All performance figures stated above are for investment options available in the Corporate Super Division of the Mercer Super Trust. Past performance is not a reliable indicator of future performance. MERCER’ and ‘Mercer SmartPath®’ are Australian registered trademarks of Mercer (Australia) Pty Ltd ABN 32 005 315 917.